In today’s rapidly evolving business landscape of Singapore, the insurance industry stands as one of the most competitive and challenging sectors. Amidst this backdrop, customer relationships have emerged as the cornerstone of long-term success. Historically, these relationships were built and nurtured through traditional channels like face-to-face interactions and telephone calls.

Insurance providers may now interact with clients on a variety of channels, from emails and social media to mobile applications and chatbots. As a result, managing these many channels effectively has become more difficult, emphasising the urgent need for reliable CRM solutions in Singapore.

What is CRM?

- Definition and Components

CRM, or Customer Relationship Management, is essentially a system that aids in managing interactions with existing and potential clients. It consists of a centralized database, automated workflows, multi-channel support, analytics, and other features tailored to enhance customer experience.

- Types of CRM Software

There are various types of CRM software available in the market, from basic database systems to more complex platforms that incorporate advanced features like machine learning and data analytics. The choice largely depends on the specific needs of the insurance company.

Why CRM for insurance companies is Essential

- Stiff Competition: The insurance industry has never been more competitive. Customers now have a plethora of options to choose from, making it essential for companies to stand out. One way to do that is through superior customer service, facilitated by a robust CRM system.

- Increasingly Complex Products: Let’s face it, insurance products are often complicated. The complexity increases the likelihood of misunderstandings and misinformation. CRM systems can help by keeping accurate records of all customer interactions, enabling personalized and clear communication.

- Regulatory Compliance: Regulatory compliance is not just a buzzword; it’s a necessity. CRM systems help maintain detailed records, making it easier to adhere to industry regulations.

Features of CRM That Aid in Customer Communication

- Centralized Database

Arguably, the most significant advantage of a CRM system is its centralized database. This feature allows for easy access to customer data and history, facilitating personalized and timely interactions.

- Automated Workflows

With automation, tasks such as sending policy renewal reminders become hassle-free. Additionally, automated workflows ensure that no customer inquiry goes unanswered, thereby enhancing customer satisfaction.

- Multichannel Support

A modern customer uses various platforms for communication. Multi-channel support in CRM helps integrate these diverse channels into a unified interface. This ensures consistent and efficient communication, regardless of the platform used by the customer.

- Analytics and Reporting

Data-driven decisions are the need of the hour. CRM systems offer robust analytics and reporting features that help evaluate the effectiveness of your communication strategies. This, in turn, provides valuable insights for future planning.

- Customer Segmentation

Not all customers are the same, and neither should your communication be. CRM allows you to segment your customer base according to various metrics like age, policy type, or communication preferences, enabling more targeted and effective interactions.

- Customer Feedback Mechanisms

Feedback is invaluable for any business. CRM systems come equipped with tools to collect and analyse customer feedback. Subsequently, you can use this data to refine your strategies and improve your services.

Best Practices for Implementing CRM for insurance companies

- Selecting the Right Solution: Choosing the CRM that fits your needs is the first critical step. Various options are available, each with its unique features and pricing. Consider your business size, goals, and budget when making a decision.

- Staff Training: For CRM to be effective, your team needs to know how to use it. Comprehensive training sessions can go a long way in ensuring smooth implementation.

- Continuous Monitoring and Updates: The work doesn’t stop after implementing a CRM system. Continuous monitoring and timely updates are crucial for keeping the system aligned with your evolving business needs.

- Inter-departmental Collaboration: A CRM software for insurance company is most effective when used across all customer-facing departments. Encourage collaboration between departments like sales, customer service, and underwriting for a more cohesive communication strategy.

Challenges and Roadblocks

- Data Security

Given the sensitive nature of customer data, security is a top concern. Ensure that the CRM system you choose complies with data protection regulations.

- Organizational Resistance

Change is hard, and resistance is inevitable. However, the benefits of CRM far outweigh the initial challenges. It is essential to have the approval of every stakeholder involved to guarantee successful implementation.

- Budget Constraints

While CRM for insurance companies offer a high return on investment, the initial setup cost can be a hurdle for some companies, especially smaller ones. Carefully evaluate the ROI before committing.

- Compliance and Ethical Considerations

Navigating the maze of regulatory requirements becomes more manageable with CRM. A well-implemented CRM system can automatically flag non-compliance issues before they become a problem. Furthermore, ethical considerations, especially concerning data handling, can be effectively managed.

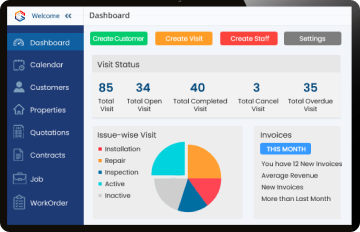

Top CRM solutions in Singapore

We have explored the features of CRM software and understood its role in Insurance. Now if you are thinking of opting for CRM software, here is a list of top software providers for CRM for insurance companies:

These are some of the top customer relationship management software providers in Singapore for Insurance companies. They provide trusted, reliable, affordable, and efficient CRM solutions. Go through these companies, analyse them, and make an informed decision for choosing the best option for your company.

Read More – Find the Right Custom Software Development Company

Future Trends

- Artificial Intelligence and Machine Learning

Expect CRM systems to become smarter. Artificial Intelligence and Machine Learning are set to revolutionize how CRM systems interact with data, offering even more personalized customer experiences.

- IoT Integration

The Internet of Things (IoT) has significant potential in enhancing proactive customer communication. For example, smart devices can provide real-time data that can be used for personalized insurance packages.

- Advanced Analytics

As data analytics tools become more sophisticated, expect more in-depth customer insights that can be used to fine-tune communication strategies.

- Strategies for Measuring ROI of CRM Implementation

Evaluating the effectiveness of a CRM for insurance company is essential for long-term success. Key Performance Indicators (KPIs), such as customer retention rates, can provide valuable insights. Furthermore, a detailed cost-benefit analysis will give you a clear picture of the ROI. Finally, consider long-term metrics like Customer Lifetime Value (CLV) to measure the real impact of your CRM strategies.